18 March 2023, Kuala Lumpur Malaysia; Yu Kuan Chon, the leader of the YU Syndicate, has been dealt a series of devastating blows in his failed quest to acquire a Malaysian securities firm. Despite his best efforts to manipulate the market and deceive regulators using underhanded tatics and proxy shareholders, his attempts have been thwarted at every turn.

His first failure came when Hong Leong Capital Bhd suspended its trading for 5 years in response to his move to gain ownership leverage and control over the securities firm by blocking a privatization exercise by its parent. This created a stalemate and he was blocked.

Yu Kuan Chon tried to officially buy PM Holdings Bhd. Regulators would not approve him as the controlling Shareholder. He then bought into PM Capital Bhd with Proxies, but failed when the controlling shareholder blocked him with PN17. Recently he has been using proxy shareholders to buy into MUIIND (Ultimate controlling shareholder of PM Group) while suing all of them. MUIIND’s answer is simple, sell the PM group off and get rid of the Yu Syndicate all together.

Share Price Manipulation of YNH Property Bhd and Rapid Synergy Bhd

He tried for more than a year to gain approved by the Regulators to control PM Securities Bhd, but was left wanting. Sources close to the matter said investigators could see what was happening with the YNH Property Bhd and Rapid Synergy Bhd share price manipulations and how close the traders were affiliated to the YU Syndicate and Yu Kuan Chon, so they took measures to protect the integrity of the markets.

Just weeks before he announced cancelation of the PM Holdings Bhd purchase agreement, the SC reprimanding and banned three stock brokers for creating a false market for Rapid Synergy and YNH Property, two Companies of the YU Syndicate that are controlled by Yu Kuan Chon and his brother Yu Kuan Huat.

Apparently there was not enough evidence to tie Yu Kuan Chon directly to the manipulation, but it is clear that he benefited from the price manipulation. This is hardly surprising given Yu Kuan Chon’s reputation as a neurotic and paranoid businessman who won’t even shake a man’s hand when he does a deal. All of the companies he is controlling mysteriously go up in value even though the financial conditions do not warrant.

In 2022 Yu and several of his proxies opened or increased their positions in MUIIND, the ultimate parent company of it all, seemingly in an attempt to exert more pressure onto the board of directors to hand over PM Securities one way or another.

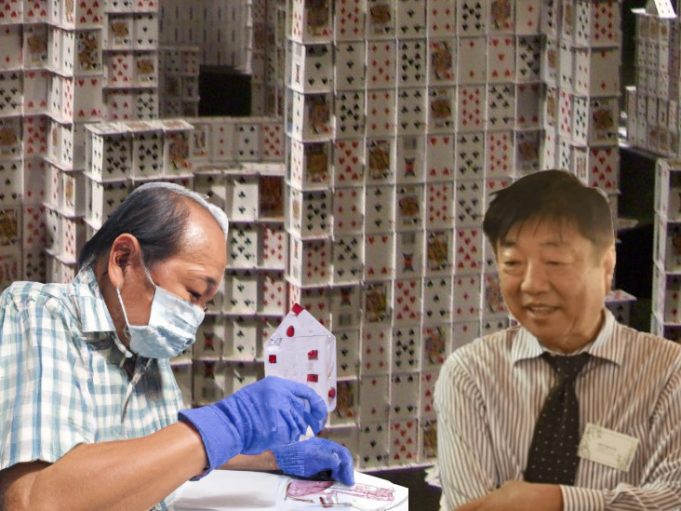

Yu Kuan Chon is not one to admit defeat easily. He uses proxy shareholders such as Yu Kuan Huat, Teh Nai Sim, Yu Chong Choo, Yu Choon Geok, Ng Choon Hua, Ho Swee Ming, Chan Sow Keng, Yu Chong Chen, Chan Weng Fui, Lim Wen Tzer add a collection of other YU Syndicate members to front his activities.

Chan Weng Fui (Puppet Poser, Proxy, and YNH employee Daniel Chan) filed a lawsuit in behalf of Yu Kuan Chon, he claimed that the vote to sell PM Securities should be invalidated because it is a related party transaction and therefore the deal to sell PM Securities should be cancelled. It seems Yu Kuan Chon cannot handle losing what little control he has and is willing to fight tooth and nail to get his way.

However, the truth is that Yu Kuan Chon is running out of securities firms willing to work with him and his proxies. Regular violations of SC regulations and significant irregularities have made him a target for Investigators.

It is likely that the high PE ratios of YNH (650+) and Rapid Synergy (+-400) in any given quarter are not organic. It is a shame that actual individual trading data is not available for an independent audit to identify why and who is playing with the stock and how it does not raise alarms in the SC monitoring systems.

This is a dangerous situation for investors as many of the shares pledged by YNH YU Syndicate members use PM securities. Given the high PE ratios of YNH and Rapid Synergy, one has to wonder if the new owners who take over are dim-witted enough to allow the continued use of these stocks as security for loans and credit.

Exposing the Dangers of Untrustworthy Individuals Controlling Securities Firms: Lessons Learned from Yu Kuan Chon’s Failed Quest for Ownership

In conclusion, Yu Kuan Chon’s failures to achieve success in his quest for ownership of a securities firm have been stopped so far. He has been unable to fool the watchful eyes of regulators, and his underhanded tactics have been exposed. Using proxies to buy control of companies is transparent and being watched.

The potential consequences of allowing untrustworthy individuals to control a securities firm are alarming. Not only could investors lose money, but the integrity of the market could be compromised. If such individuals were to engage in manipulative practices, it could cause a ripple effect throughout the entire market, leading to widespread damage and distrust.

It is essential that regulators remain vigilant and take swift action to prevent such individuals from gaining control of securities firms. Additionally, investors must do their due diligence to ensure they are not inadvertently supporting such practices by investing in companies controlled by untrustworthy individuals. By working together to promote transparency and integrity, we can help protect the market and ensure a fair and safe environment for all.

The dangers to financial institutions that allow the use stock as collateral that are not organically trading have been highlighted, and it is up to investors to be cautious in their dealings with companies controlled by Yu Kuan Chon and the YU Syndicate